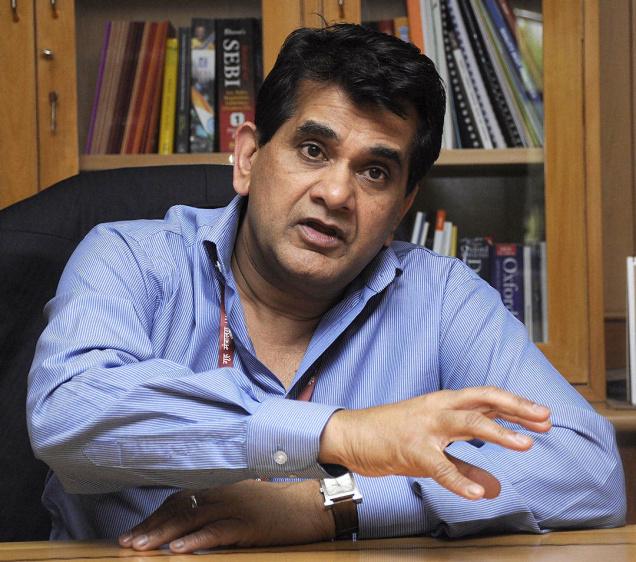

Japiur– Within three years, cash machines in India will be completely irrelevant. This bold prediction of NITI Aayog CEO Amitabh Kant was greeted with a mixture of enthusiasm and scepticism by the audience at a session here at Jaipur Literature Festival.

“We’re in the middle of a major disruption,” said Kant.

“At the moment, 85 per cent of transactions are in cash, which creates more opportunities for black money. But we have seen extraordinary growth in mobile phones, meaning the infrastructure for a cashless economy is there.”

Aruna Sunderarajan, newly-appointed secretary of the Ministry of Information and Technology, said: “Once the four big telcos swing behind digital banking, which will happen next year, the cashless economy will grow exponentially. Look at the example of Kenya — it’s less banked and less advanced technologically, yet 50-60 per cent of financial transactions happen on phones.”

Mihir Sharma, opinion editor of the Business Standard, was more sceptical. “It’s true that mobile phone usage has grown exponentially, but that was because landlines didn’t work. The government took the wrong lesson from this. It never forced people to use mobile phones. Government got out of the way; it let people choose to use them. It happened naturally, not by government pushing it. That’s how to leapfrog forward technologically.”

Ashok Wadhwa, banker and CEO of Ambit Holdings, was also sceptical about the pace of transition to a cashless economy. “No question that’s the destination, but things don’t always happen that quickly in India. It took a decade to open up the stock market in the 1990s. I personally think the transition to a cashless economy will also take longer.”

Moderator John Elliott, author of several books on India, also seemed sceptical. “I can’t even get internet in central Jaipur. How is this going to happen in three years?”

Kant retorted: “It will happen because technology will make it so easy; even you can use it, John.”

Sharma interjected: “If it was so easy to use, why did the government have to take away 85 per cent of all cash? Was the shock of demonetisation really necessary?

“It enabled the push towards a digital economy in a much quicker way,” argued Kant.

“Disruptive policies have been responsible for rapid change before in India”, agreed Wadhwa. “But we need to get the right internet infrastructure in place. And we need to remove the bureaucratic paperwork for people to set up new accounts.”

Is the cash economy really so dirty, asked an audience member. “India has a $2 trillion economy, and a $1 trillion black economy,” said Kant.

“If you want it to become a $10 trillion economy, you need to smash the black economy. Around 98 per cent of Indians don’t pay tax. That restricts India’s ability to grow.”

The session ended with a poll of the audience — did they think the digital economy had harmed the bricks-and-mortar businesses in India? The final result: 57 per cent thought it had.