By Meghna Mittal and V.S. Chandrasekar

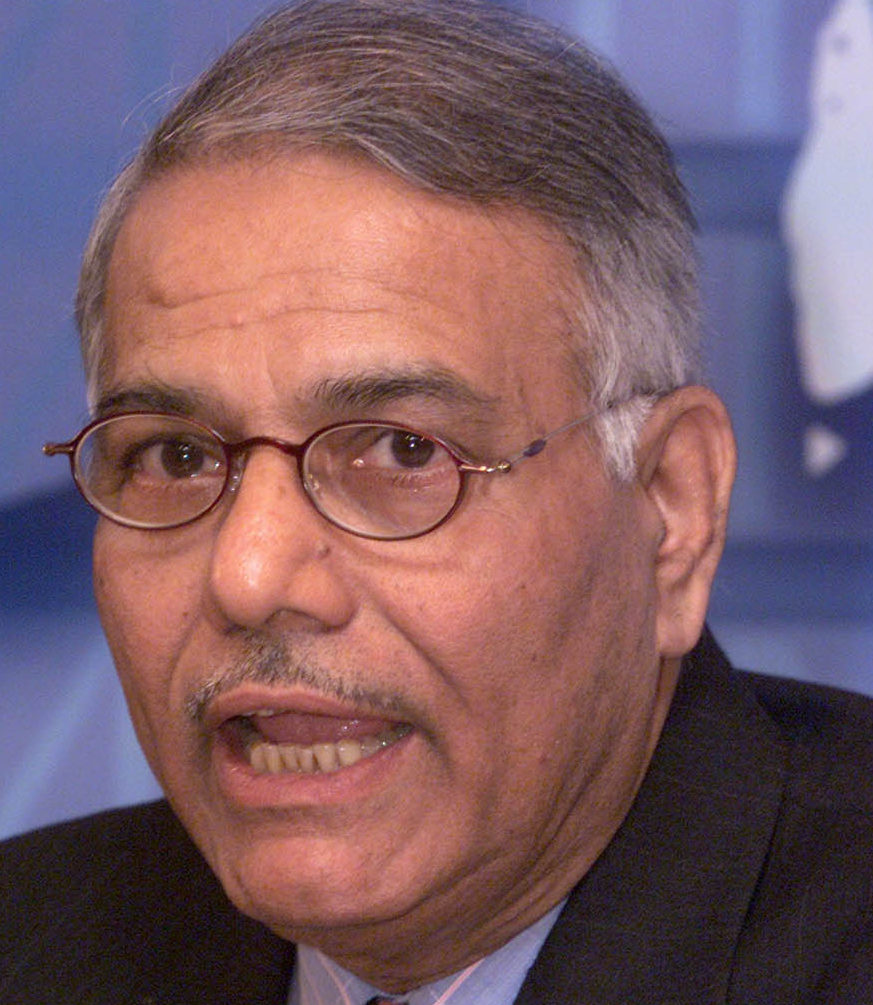

New Delhi–Former Finance Minister and BJP leader Yashwant Sinha says the Indian economy is actually growing at five per cent as against the over 7 per cent recorded by the Central Statistics Office (CSO).

The government has said the economy is growing at over 7 per cent but that is according to the new formula “and if the growth is calculated according to the old formula, then the growth is at 5 per cent”, Sinha told IANS in an interview.

“Clearly 250 bps difference in growth is there between the old and the new formula. We are at around 7 per cent according to the new formula. My take is that according to the old formula, we are at around 5 per cent,” he said.

The government in 2015 had changed the GDP calculation method, which apart from changing the base year to 2011-12, started measuring growth using gross value added (GVA) at market price and not factor cost. GDP thus now takes into account the market prices paid by consumers and not factor cost of products which the producers received.

Former Reserve Bank of India (RBI) Governor Raghuram Rajan had earlier raised concerns about the change in computation methodology of GDP.

The former Finance Minister said that the government seems to have disturbed the sequence of investment and consumption, which is affecting growth.

“In this government, we have finished three years. Government is spending money from its Budget, but private investment is not taking place because of bank non-performing assets (NPAs). It appears to me that again the sequence between investment and consumption has got disturbed somewhere. So we may have some consumer demand, but hardly any investment demand because investment is not taking place,” he said.

Talking about demonetisation, Sinha said he would not acknowledge it as an economic reform and questioned the delay in disclosing the total deposits received during the period.

“Demonetisation was an administrative step. I would not regard it as an economic reform. The purpose was to capture black money, but since even after eight months we don’t have the basic figure of how many notes in circulation came back, you are not in a position to pass any judgement,” he said.

“We can’t pronounce judgement on the effect of demonetisation in any holistic manner unless the basic figure is revealed. How were the RBI giving the figures earlier? Every week they were declaring that so much currency has come back. It’s only when they started reaching that level that was in circulation, that they stopped talking. So they (government) might have said, find some reason for not giving the final figure,” he added.

RBI Governor Urjit Patel had earlier appeared before the standing committee of Parliament and disclosed that demonetisation was done because the government wanted it done.

Sinha said that if the entire Rs 15.44 lakh crore worth of high denomination currency that was in circulation prior to demonetisation has come back as deposits, the government will have some explaining to do.

“Suppose Rs 11 lakh crore came back and Rs 4 lakh crore has not come back, we would have easily concluded that Rs 4 lakh crore was black money which did not come back to the system. But if Rs 15-16 lakh crore has come back, then we need to explain,” he said.

“You are watching the scene as much as I am, and nobody can say that we have achieved the objectives — that counterfeit currency is not back… as corruption continues,” he added.

Sinha asserted that the state of the economy has remained unchanged in the last three years.

“There is a question of employment generation. Is the economy generating enough employment? The answer from government statistics is no. Is private sector investment taking place? The answer is no. If you ask me about reform measures and state of economy, I say not much change has taken place in the last three years,” Sinha told IANS.

“We should clearly know what we mean by economic reforms. It’s been 26 years since reforms started and everything is touted as economic reforms. I define economic reforms as those steps or measures which will fuel the engine of economic growth,” he said.

Sinha said the festering problem of non-performing assets (NPAs) that was inherited by the Modi government in 2014 despite various reform measures has worsened in the last three years.

“The most important issue that the economy was faced with when this government came into power in 2014, was the twin problem of stalled projects and bank NPAs. Bank NPAs happened because projects were stalled and some other factors combined to slow down the economy,” Sinha said.

“That problem has stayed, and in fact worsened in the last three years. Despite all steps initiated by the government, we don’t see the impact on reduction in NPAs and banks’ lending to private sector,” he said.