Washington— The Republican-led U.S. House of Representatives narrowly passed a wide-ranging tax and spending bill on Thursday, despite strong warnings from fiscal watchdogs that the measure could significantly worsen the national debt.

The bill passed by a razor-thin margin of 215–214, with all Democrats and two Republicans voting against it. One Republican voted “present,” opting not to take a position.

The legislation seeks to extend the corporate and individual tax cuts first enacted during former President Donald Trump’s administration in 2017. It also introduces new tax breaks aimed at benefiting service workers and middle-class earners, including deductions for tips, overtime pay, and car loans.

In addition to its tax provisions, the bill boosts defense spending and allocates more funds toward immigration enforcement, including increased resources for deportations. It also rolls back several key green energy policies implemented under President Joe Biden and raises the eligibility thresholds for federal assistance programs such as food stamps and Medicaid, with the aim of curbing government expenditures.

The bill now heads to the Republican-controlled Senate, where it is expected to undergo revisions.

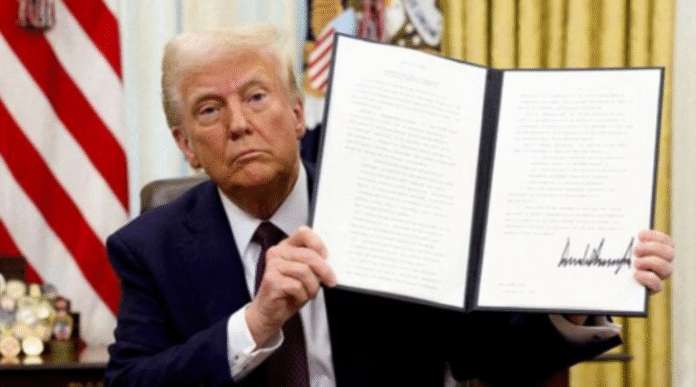

Former President Trump celebrated the House vote, calling the legislation “THE ONE, BIG, BEAUTIFUL BILL” in a post on his Truth Social platform. He claimed it could be “the most significant piece of legislation ever signed in the history of our country.”

Budget analysts, however, voiced alarm over the potential fiscal consequences. Maya MacGuineas, president of the Committee for a Responsible Federal Budget, sharply criticized the bill, calling it “an insult to fiscal responsibility” that could add more than $3 trillion to the federal deficit. She also warned that extending these policies in the future could cost trillions more.

The U.S. national debt currently exceeds $36.2 trillion, according to the Treasury Department.

House Speaker Mike Johnson, facing a slim 220–212 Republican majority, had to make last-minute concessions to various GOP factions to secure enough votes. He hailed the legislation as “generational, truly nation-shaping,” and emphasized its long-term impact on America’s economic and security posture.

The 1,100-page bill largely reflects Trump’s populist economic agenda, featuring expanded tax relief for working-class Americans, increased military funding, and a crackdown on illegal immigration. At the same time, it undoes much of the Biden administration’s climate policy framework.

The Congressional Budget Office estimates that the bill, if enacted in its current form, would add approximately $3.8 trillion to the federal deficit over the next decade. (Source: IANS)