Seoul– Samsung Group, the country’s largest conglomerate, is likely to ramp up its investment in chip plants amid the global shortage and merger and acquisition (M&A) with the parole of its leader despite controversy over the legitimacy, industry insiders said on Monday.

The parole board under the justice ministry approved Lee Jae-yong’s release from jail after hours of review, making him free from Friday.

The Samsung Electronics Vice Chairman has been behind bars since January after he was sentenced to 2 1/2 years in prison by the Seoul High Court in a retrial of a bribery case involving former President Park Geun-hye.

Lee’s parole comes at a time when Samsung is reviewing its investment and M&A plans. With the tech giant’s top decision maker soon to be released, industry observers expect that Samsung will speed up its major business plans in the near future, reports Yonhap news agency.

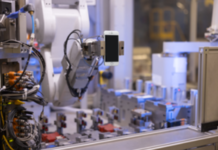

Samsung Electronics, the world’s largest memory chip and smartphone vendor, is currently looking to build a $17 billion foundry fab in the US, but has yet to decide its location.

Sites in Texas, Arizona and New York have been mentioned as candidates, but the company is reportedly still negotiating with municipal authorities over incentives for a new chip facility.

The decision on the US chip plant is critical as Samsung’s rival companies are moving ahead to expand their production capacities amid global chip shortages.

Taiwan Semiconductor Manufacturing Co., the world’s largest contract chip maker, recently revealed that it will invest $100 billion over the next three years for capacity expansion.

With its new $12 billion chip plant in Arizona set for mass-production in 2024, speculation has been growing that the Taiwan company may also build chip factories in Germany and Japan.

Intel, the world’s leading semiconductor seller, also announced that it will invest $20 billion to expand its chipmaking capacity in the US and is looking to re-enter the foundry business with the company reportedly reviewing a deal to acquire GlobalFounderies Inc.

With Lee’s parole, Samsung is also expected to put final touches on its M&A plans. In a conference call last month, the company reiterated that it will pursue a “meaningful” M&A deal within three years and that it is looking into various areas, including artificial intelligence, 5G and automotive.

Samsung’s last major M&A deal came in 2016 when it acquired U.S.-based automotive giant Harman International Industries for $8 billion.

“Making decisions in areas that require big investments and no immediate profits are produced, such as foundry and logic chips, is like placing a bet,” a company official said on condition of anonymity. “That’s something a professional CEO cannot easily do, but an owner of the business can do.”

Even if Lee returns to business, watchers said that Samsung may not make big progress immediately as his activities are likely to be limited under the law.

Since Lee will be released on parole, not a presidential pardon, he is subject to the law. However, Lee can be exempted from the regulation if he is able to get the justice minister’s special permission.

Lee is currently dealing with a case over a controversial merger of two Samsung affiliates and alleged accounting fraud. He will also face a court trial on charges of illegally taking propofol injections. (IANS)