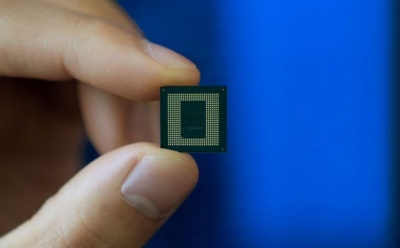

Seoul– Global DRAM demand is expected to overtake supply as early as July, a recent industry report showed on Thursday, in a change that would lessen pressure on semiconductor companies reeling from a chip downturn.

Market research firm TrendForce expected in its May report global DRAM demand this year to top 105.4 billion 2-gigabyte chips, surpassing an estimated supply of 104.3 billion chips.

In its April report, the company estimated annual supply at 155 billion versus demand at 146 billion, expecting a chip glut to continue hurting global chipmakers’ bottom lines, reports Yonhap news agency.

The change in its forecast came after Samsung Electronics Co., the world’s largest memory chip maker with a 43.2 percent market share, said last month it was reducing memory output “to a meaningful level,” in a sharp departure from its previous position that it would not artificially reduce output as part of efforts to gain a bigger market share.

Samsung said it had started cutting production of the legacy products that it had already secured sufficient volume of to meet mid-to long-term demand.

The production cut came on top of the factory line optimization that began early this year, the tech giant said, adding that its inventory normalization will accelerate in the second half.

Its smaller rivals like SK hynix and Micron Technology had moved several months earlier than Samsung did and pulled back on production in order to ease a severe supply glut that drove down prices.

SK hynix and Micron took up 23.9 percent and 28.2 percent of the DRAM market, respectively, in the first quarter.

According to TrendForce, global DRAM was oversupplied at 114.5 percent in January.

For the three months ending in March, global DRAM sales dropped 21.2 percent to $9.66 billion compared with the previous quarter.

Capacity utilization rates of Samsung, Micron and SK hynix were projected at 77 percent, 74 percent and 82 percent, respectively, in the second quarter, TrendForce said. (IANS)