By Aparajita Gupta

New Delhi– People may be queuing up and jostling in front of the banks and ATMs to get hard cash for daily sustenance after the government demonetised Rs 500/Rs 1,000 notes, but it’s the mobile wallet companies that are laughing all the way to the bank.

“Airtel Money, our mobile wallet, has seen a big surge in transaction value and in cash-loading. The value is set to accelerate further in the coming days as we have announced a new promotion offer of 10 per cent cash back on the wallet usage,” Shashi Arora, MD and CEO of Airtel Payments Bank, told IANS.

He said the company was also seeing a “significant spike” in the number of new users as well as app downloads.

Prime Minister Narendra Modi declared in a televised address to the nation on November 8 that Rs 500 and Rs 1,000 notes would no longer be considered legal tender from midnight that night.

Since then, people have been running around from banks to ATMs to get money exchanged or to deposit it in their accounts. But for the mobile wallet companies, this opens up opportunity to expand their business rapidly. “We are well positioned to leverage this growth opportunity,” Arora said.

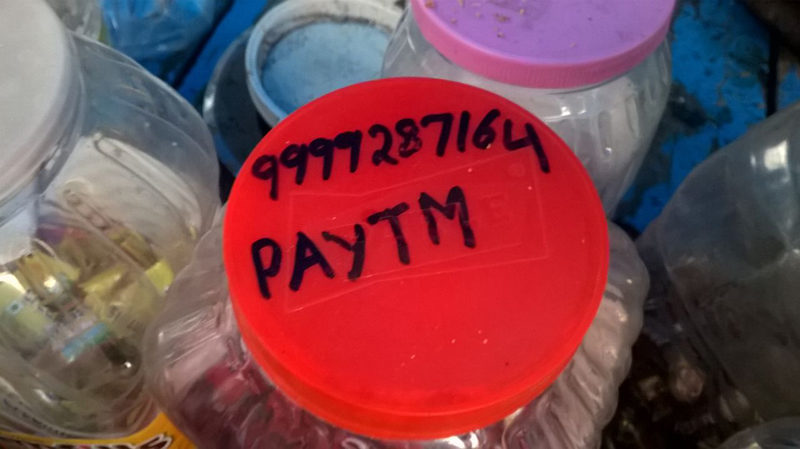

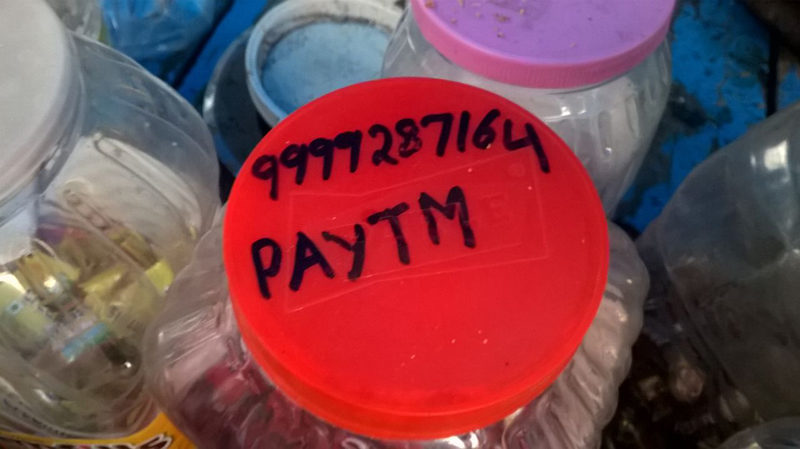

People usually use mobile wallets to pay for mobile recharges, utility bills and buying goods from key partners of the wallet company. But increasingly, users are paying with digital wallets at merchant outlets and eateries.

“This is the biggest and most ambitious step ever to crack down on black money and fake currency. Since Paytm is fast becoming synonymous with all kinds of (digital) payments, we have registered a strong surge in volume on our platform,” Madhur Deora, Chief Financial Officer, Paytm, told IANS.

He said that a day after the government announced the black-money measure, traffic through its mobile wallet app increased by 435 per cent. It saw around 200 per cent increase in transaction value.

A recent study by industry chamber Assocham and research firm RNCOS said the transaction volume of mobile payments in India is likely to witness an exponential compounded annual growth rate (CAGR) of over 90 per cent to reach Rs.15,300 crore by fiscal 2022 against about Rs.300 crore in fiscal 2016.

The transaction value is also likely to register more than 150 per cent compound annual growth rate and cross Rs 2,000 lakh crore by fiscal 2022 from just over Rs 8 lakh crore as of fiscal 2016, the study said.

The mobile wallet companies of course feel that the latest move by the prime minister would sharply boost their volumes and their bottomlines. Mobikwik said its overall transactions increased 18-fold following the demonetisation.

“With this policy change, we expect a 10 times impact — we expect to easily hit $10 billion (Rs 67,500 crore) in payment volumes by 2017,” Mobikwik Founder and CEO Bipin Preet Singh told IANS.

He said that Indians make about $1 trillion of payments annually with more than 90 per cent being in cash. Now this would change.

The company’s growth projections have been revised to register five times higher growth. After the government announcement, Singh said the company had seen a 2,000 per cent increase in “add money” and transaction value.