WALTHAM, MA–Startups in the United States raised 766 financing rounds in February, a seemingly strong number amid market volatility and the bubble talk that has hung around recently, according to PitchBook.

In its monthly snapshot, PitchBook said that more than 70% of the capital invested during the month was deployed in roughly 11 percent of the deals closed, however, including the $1 billion round for Chinese sports streaming platform LeTV and an almost $800 million financing of cinematic reality company Magic Leap.

33 February deals (<4%) raised $50 million or more.

33% of the total deals were made at the early stage, whereas late stage accounted for 20 percent.

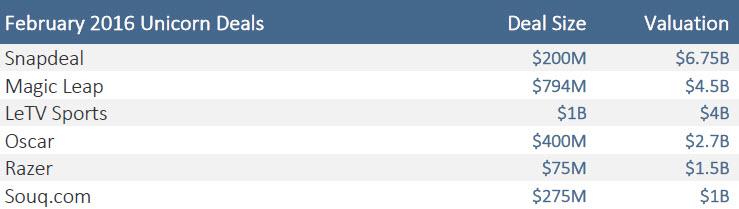

6 new and existing unicorns attracted funding rounds.

Other facts from the PitchBook:

“82 VC-backed companies were exited by investors in February. Notable acquisitions of the month include Microsoft’s $450 million purchase of Xamarin and the $410 million buy of Ellipse Technologies by NuVasive. After more than a month with zero U.S. IPOs, February saw three VC-backed companies enter the U.S. markets through an initial offering—Editas Medicine, Proteostasis Therapeutics and AveXis.

605 VC investors were active last month, though just one investor (New Enterprise Associates) completed double-digit deals and only 142 (23.5%) completed more than one. Deal activity during the month breaks down as follows—seed: 19%, early stage: 54%, late stage: 25%.

36 VC funds closed last month, courting more than $7 billion in commitments. Seven of those vehicles closed on $500 million or more, including General Catalyst Group VIII ($845 million) and Index Ventures Growth IV ($700 million). Nearly two-thirds of the new funds were closed by U.S.-based investors. Chinese VCs closed four vehicles, adding more than $1.3 billion.”