Ahmedabad— Adani Airports Holdings Ltd (AAHL), a subsidiary of Adani Enterprises Ltd and India’s largest private airport operator, announced on Wednesday that it has raised $750 million through External Commercial Borrowings (ECB) from a consortium of international banks.

The funds will be used to refinance $40 million in existing debt and support infrastructure upgrades and capacity expansion at six key airports: Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, and Thiruvananthapuram. The financing will also help scale non-aeronautical businesses across AAHL’s network, including retail, food and beverage, duty-free, and airport services.

“The trust shown by leading global financial institutions highlights the long-term value and potential of India’s aviation infrastructure,” said Arun Bansal, CEO of AAHL. “We are focused on delivering seamless, tech-enabled operations, world-class customer experiences, and sustainable airport infrastructure.”

The financing deal was led by First Abu Dhabi Bank, Barclays PLC, and Standard Chartered Bank.

In FY 2024–25, AAHL handled 94 million passengers with an overall capacity of 110 million. The company plans to triple that capacity to 300 million passengers annually by 2040 through phased development.

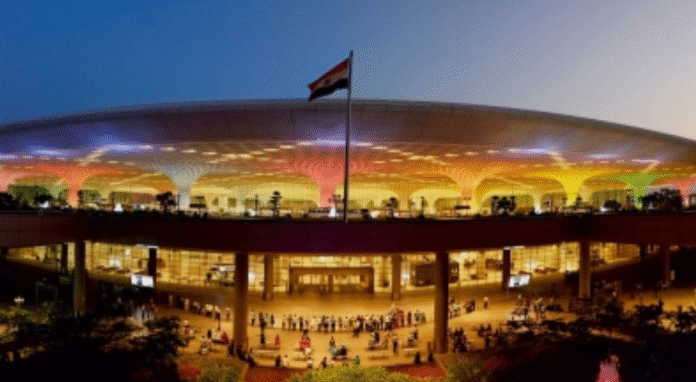

A key part of that strategy is the Navi Mumbai International Airport, expected to become operational soon. The first phase will add capacity for 20 million passengers, eventually expanding to 90 million per year and significantly boosting the Mumbai region’s aviation capacity.

AAHL holds a 74% stake in Mumbai International Airport Ltd, which in turn owns a 74% stake in Navi Mumbai International Airport Ltd.

With eight airports under its management, AAHL accounts for 23% of India’s total passenger traffic and more than 29% of the country’s air cargo volume. (Source: IANS)