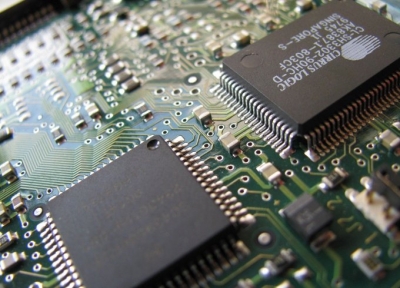

New Delhi– Global semiconductor revenue is projected to decline 11.2 per cent to reach $532 billion in 2023, and the short-term outlook for the semiconductor market has deteriorated further, a report showed on Wednesday.

In 2022, the market totaled $599.6 billion, which was marginal growth of 0.2 per cent from 2021, according to the latest forecast from Gartner.

The PC, tablet and smartphone semiconductor markets are stagnating. The combined markets will represent 31 per cent of semiconductor revenue in 2023 and total $167.6 billion.

“As economic headwinds persist, weak end-market electronics demand is spreading from consumers to businesses, creating an uncertain investment environment,” said Richard Gordon, Practice Vice President at Gartner.

In addition, an oversupply of chips which is elevating inventories and reducing chip prices, is accelerating the decline of the semiconductor market this year,” Gordon added.

The memory industry is dealing with overcapacity and excess inventory, which will continue to put significant pressure on average selling prices (ASPs) in 2023.

The memory market is projected to total $92.3 billion, a decline of 35.5 per cent in 2023. However, it is on pace to rebound in 2024 with a 70 per cent increase.

The DRAM market will witness significant oversupply for most of 2023 due to weak end-equipment demand and high inventory levels despite flat bit production by DRAM vendors.

DRAM revenue will decline 39.4 per cent this year to reach $47.6 billion. The market will move to undersupply in 2024 and DRAM revenue is set to increase 86.8 per cent as pricing rebounds, the report mentioned.

The dynamics for the NAND market will be similar to the DRAM market. As a result, NAND revenue is projected to decline 32.9 per cent to $38.9 billion in 2023.

“The past decades of high volume, high-dollar content market drivers are coming to an end, notably in the PC, tablet and smartphone markets where technology innovation is lacking,” said Gordon.

In addition, Covid-19 and the US and China trade tension have precipitated the deglobalization trend and the rise of techno nationalism.

“Semiconductors today are seen as a national security issue,” said Gordon. (IANS)